|

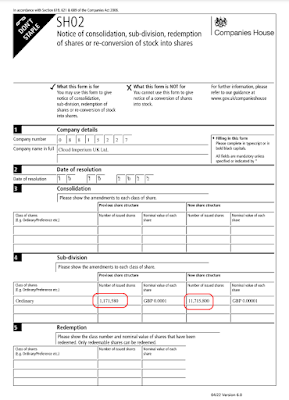

| Posted on Companies House 20 Oct 2022 |

For an explanation for what a sub-division is in the U.K., I went to CompanyWizard, a company that specializes incorporating new companies in the U.K. A subdivision, or share split, is:

Share splitting is an option open to companies whereby each share will be subdivided into two or more new shares. This means that the individual will hold more shares but each share will have a lower nominal value.A straightforward split will not change the shareholders’ rights, this means that the voting control and rights to dividends will be unchanged after the split. All that has changed is the number of shares and the nominal value of each share.

Before writing this post, I asked around on why CIG might have conducted a share split. A passage from the CompanyWizard website summarized the answers I received.

The main reason for doing a share split is to improve the liquidity of the company’s shares.For example, if a company owner has just 1 ordinary share with a nominal value of £1 they cannot sell half a share, but if there were 100 ordinary shares with a nominal value of 1p, the owner could choose to sell 50 shares. In the same way, a new investor might no be comfortable investing £1000 and only receiving one share, however, they may be more comfortable receiving 1000 shares worth £1 each.Share splits are frequently done by publicly quoted companies because it can reduce the share price in line with the split, but it does not reduce the market value of the company.

"Improving the liquidity of the company's shares" sounds like CIG possibly is seeking additional outside investment into the company. Considering CIG is experiencing the highest revenue in its history in 2022, with sales to exceed well past $100 million, the news might come as a surprise.

The last time CIG conducted a share split was in December 2017, when the stock split from 100 to 1 million shares. The announcement of the Calders' investment in CIG was not made until December 2018. I should note that the appointments of Ezer Klein and Daniel Offner to the CIG board of directors on 23 May 2018 were likely connected to the $46 million investment the Calders made in 2018.

Another possibility is much more benign. With the current inflationary economy in the United Kingdom, which rose at a rate of 11.1% from October 2021 to October 2022, the leadership might have decided to pass out shares instead of big pay raises as compensation. By conducting a 10:1 share split to create over 11 million shares, employees might feel more appreciated at receiving 10 or 20 shares instead of 1 or 2.

Either way, the public is unlikely to find out the truth for a few months, if not for a year or two. For now, we just have a tantalizing filing announcing a 10:1 share split occurred in October.

No comments:

Post a Comment