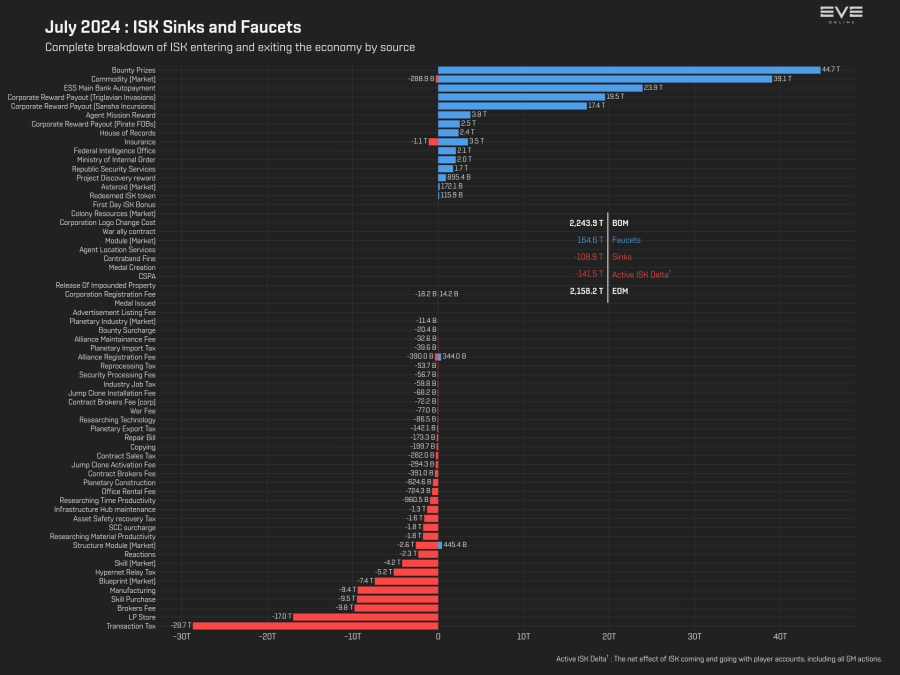

While CCP's overlords in Anyang, South Korea are basking in the EVE IP's financial performance in the second quarter, clouds appeared on the horizon today in the form of EVE Online's monthly economic report (MER) for July. Specifically I'm looking at the 6.3% of ISK that left the New Eden economy as measured by the Active ISK Delta.

|

| Sinks, Faucets, and the Active ISK Delta |

The Active ISK Delta is the net effect on the New Eden monetary supply of players leaving and returning to the game. The Active ISK Delta also includes any reductions due to any and all GM actions. In July, 141.5 trillion ISK disappeared from the game economy from the movement of players into and out of the game. The change turned the Active ISK Delta from the 6th biggest ISK faucet in June (4.7 trillion ISK, tied with skill books) to the largest ISK sink in July by a very large margin.

|

| Active ISK Delta in the Second Expansion Era |

That the game experienced a larger than normal Active ISK Delta following an expansion launch month is expected. The size, though, is historic. Since the beginning of the Alpha and Omega free-to-play era at the end of 2016, July's Active ISK Delta is the largest amount of ISK removed from the economy.

|

| Most ISK lost due to player inactivity/quitting since introduction of Alpha clones |

In percentage of the money supply removed in a single month, however, the record still is held by January 2019 in which 7.2% of the ISK was lost due to players leaving the game or GM actions.

The big decline probably isn't that unexpected to long time EVE players. The summer slump is a well-known phenomena. And with the return of the biannual expansion, the natural decline the following quarter is just amplified in the 3rd quarter. But I don't think our overlords in Anyang realize the natural cycles in EVE.

Listening to the earnings call Wednesday night an investment analyst asked if the EVE IPs performance in the second quarter was a temporary peak. I believe the CFO replied that not only was the second quarter performance (the best in South Korean won since Pearl Abyss purchased CCP Games) not a peak, but the level investors should expect to see going forward.

Looking at not only the Active ISK Delta but the data from Dotlan Maps, I don't see revenue maintaining a level of ₩20 billion in the third quarter. While I foresee a good year-over-year revenue increase, a quarter-over-quarter decline of 20% would not surprise me. For the third quarter of 2023, EVE IP revenue fell 20.8% QoQ to ₩16 billion ($11.8 million).

Last year Pearl Abyss blamed the decline of the "base effect" of the Viridian expansion. That is, returning to normal revenue levels following an expansion's launch. After last week's answer, I'm not how Pearl Abyss explains any disappointing results on the next earnings call. Hopefully the custom SKINs feature introduced in Equinox pulls in a lot more money that I think is has.

No comments:

Post a Comment