Cloud Imperium Games had a smashing month of sales from its online cash shop in February according to data from the CCU Game dashboard. February's $7.7 million in sales was a 61.6% year-over-year increase over the $4.8 million recorded in February 2024.

The $789.5 million displayed on the Roberts Space Industries funding page at the end of February was not a comprehensive accounting for all of CIG's revenue since the project's Kickstarter in October 2012. Overall, the company has recorded $888.1 million in confirmed revenue (the funding page & the 2022 financial report).

- Sales/Pledges: $789.5 million (through 28 February 2025)

- Subscriptions: $33.0 million (through 31 December 2022)

- All other sources: $65.6 million (through 31 December 2022)

In addition, the company has received a total of $63.25 million in outside investment. According to the 2022 financial report, $4.8 million of the amount was returned to investors in 2020. Including the outside investment money, the total amount raised by CIG to create Squadron 42 and Star Citizen is $951.4 million, or $946.6 million when excluding the returned funds. An additional $5 million in shares sold in January 2025 are not included in the total.

The Funding Plateau - Over the last three years, Cloud Imperium has faced a sales plateau in the company's sales of virtual good like internet spaceships. Sales have fallen withing 3% of the average of $115.9 million between 2022-2024. I believe the shakeup of upper management that began in Q4 of 2024 is designed to break through and increase revenue for the company. So in addition to providing year-over-year metrics I will also comparing the previous month's sales to the average sales for the month from the years 2022-2024. I believe if sales continue to fall within the range of $112.4 million and $119.4 million the C-Suite at CIG, if not the board of directors, will not be happy.

In February the Marketing Masters In Manchester had a lot to smile about. Not only did sales rise 61.6% YoY, but increased over the previous 3-year average for January by 41.5%. Sales really benefitted from the continued effects of the release of Alpha 4.0.1 on 28 January and the accompanying sale of both the MISC Fortune and the Red Letter event. Over the first seven days of February, the company recorded an additional $1.6 million in sales, a $900,000 increase over sales in the first seven days of February 2024.

Additionally the Coramor event, Star Citizen's version of Valentine's Day, did quite well financially.

Featuring the introductory sale of the Super Hornet MK II as well as the Anvil F7C-M, CIG racked up $3.5 million in sales over the course of 7 days as compared to 2024's total of $1.8 million. Combined, the sales held in the first seven days of the month combined with the Valentine's event accounted for approximately $2.7 million of the $2.9 million year-over-year sales increase in February.

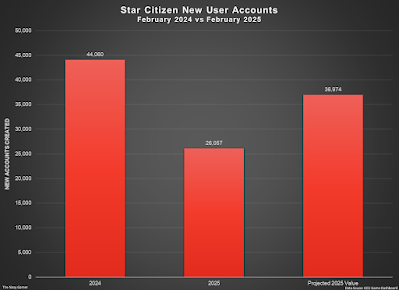

New Account Creation - From 2022 to 2024 CIG saw the number of new accounts created each year fall by 44.5%. I'm assuming that part of the shakeup is aimed at improving that performance as well. So I came up with a simple predictive formula to estimate how big of a drop in new player account creation is expected based on historical trends. For the year, my formula comes up with a 19% drop in new user accounts created in 2025, which is twice as much as I predicted at the beginning of the year.

Ongoing Concerns - I did not see any progress on my list of concerns at the end of January. The big question going into March is whether the Calders will exercise their put option in 2025 or wait until the first quarter of 2028. The father and son duo have until no later than the end of March to exercise the option. While I fully expect the Calders to choose to wait another three years in order to benefit from the release of Squadron 42, I see a non-zero chance of the second largest shareholders pulling the trigger.

Another concern is the lack of financial information for 2023 available. Yes, the month of March has arrived and still no financial report posted to the CIG corporate website. With my experience covering CCP Games the lack of posting information is a bit puzzling. The Icelandic studio only stopped posting financial information on its corporate website when it briefly didn't have outside investors or was bought by Pearl Abyss. I really don't see either condition existing at the moment.

In fact, the company issued another $5 million shares in the company in the middle of January. I really would like to know who obtained the shares, but that information probably will not become public until September.

A bigger concern is the late filing of CIG's accounts to UK Companies House. For the second year in a row the filings will occur after the 31 December deadline. The 2022 filings showed some issues with the accounts from the new auditors, including accessing the liability for the put options for 2024, 2025, and 2028 correctly.

Currently the company is facing a fine of £750 for filing its accounts late for the second year in a row. If the accounts are filed after 31 March, the fine increases to £1500. If Companies House chooses to do so, directors of the company could face criminal charges.

Currently the company is facing a fine of £750 for filing its accounts late for the second year in a row. If the accounts are filed after 31 March, the fine increases to £1500. If Companies House chooses to do so, directors of the company could face criminal charges.

One final note on the late filing of the financial accounts with Companies House. The 2022 accounts were signed and dated on 1 March 2024, electronically submitted to Companies House on 3 March, and posted to the Companies House website on 11 March. I am interested to see if history repeats itself.

No comments:

Post a Comment